Basin School District Supplemental Levy Proposal Facts

2024-25 and 2025-26

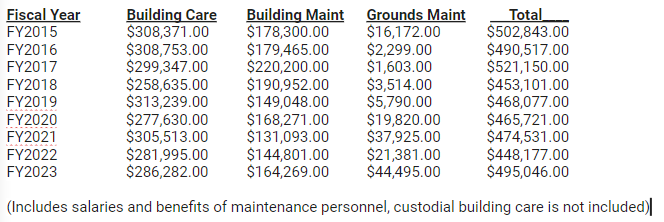

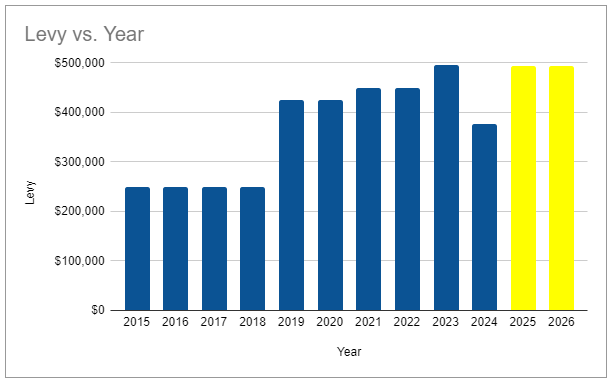

Historical Levy Data Sheet

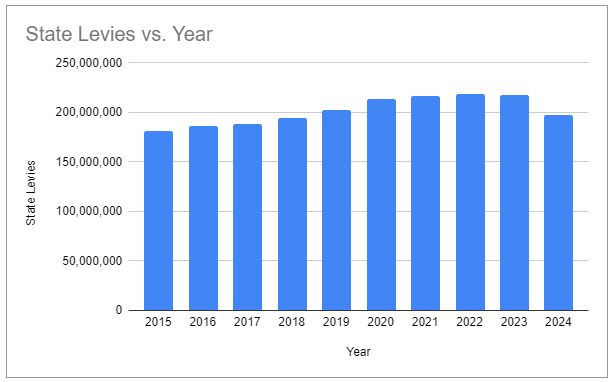

Total Levies Across The State

Why is Basin School District 72 running a levy?

The last time the education funding formula changed was 1994. We are currently funding our education system on 1994 trends and models.

Under the Idaho Constitution

ARTICLE IX – EDUCATION AND SCHOOL LANDS

SECTION 1. LEGISLATURE TO ESTABLISH SYSTEM OF FREE SCHOOLS. The stability of a republican form of government depending mainly upon the intelligence of the people, it shall be the duty of the legislature of Idaho, to establish and maintain a general, uniform and thorough system of public, free common schools.

The current funding model allocates funds to the school district based on an average daily attendance calculated from a fall and spring snapshot. This means the districts only get funding for those students in school during those snapshots. Last year, 2022-3023, we had 406 students enroll over the 9 month period. Our Average Daily Attendance was 312 students last year. Kindergartners only count for half a day even though they are full day, preschool only counts if they are on an IEP, some parents pulled their students out for home school and some placed them back in from homeschool, some students were sick, some took vacations, and some moved in and out. 406-312 = 94 students did not receive funding from the state, but the district is mandate to educate them and use resources while they are enrolled in the district. The state ends up providing around 80% of the funding for the number of students enrolled.

- Basin SD ranks 38/54 rural schools for cost per student funding Boise County Cost Per Student

- Basin SD = $14,229/student

- Garden Valley SD = $18,821/student

- Horseshoe Bend SD = $16,425/student

- Basin SD without the levy = $12,502/student

- Basin SD without levy and grants = $11,063/student

This would place the district 53rd/54th in funding among rural schools

In terms of employees this all translated to the following allocations last year. This is how the state defines the standard opereating cost of a school district:

21.94 support units (certified teachers)

2.07 Administrators (superintendents and principals)

1.66 Pupil services (counselors and school nurses)

7.88 Classified (paraprofessionals, food service, transportation, maintenance, preschool teachers, bus aids, office staff, finance)

The reality is it takes a lot to run a school district. There are certain class size restrictions, food service requirements, maintenance and operations costs, and Special Education requirements by law. Our actual numbers in 2023 were:

26 certified teachers or -4.06 funding deficit

2.5 Administrators or -0.43 funding deficit

1.66 Pupil services

13 Classified or -5.12 funding deficit

This does not include a speech pathologists, child psychologist, counselor, and occupational therapists who are all on contracts and are required by law. These all fit under pupil services which we receive funding for 1.66 employees.

Official notice voters will see on the ballot.

NOTICE OF RENEWABLE SUPPLEMENTAL MAINTENANCE PROGRAMMING AND OPERATIONS

LEVY ELECTION FOR SCHOOL DISTRICT NO. 72,

BOISE COUNTY, STATE OF IDAHO

PUBLIC NOTICE IS HEREBY GIVEN according to law and requisite action by the Board of Trustees of School District No. 72, Boise County, State of Idaho (the “District”), that a Renewable Supplemental Levy election will be held on May 21, 2024, in the District between the hours of 8:00 a.m. to 8:00 p.m., for the purpose of submitting to the qualified electors of said District their vote and determination, by affirmative vote on the following question:

QUESTION: Shall the Board of Trustees of School District No. 72, Boise County, State of Idaho (the “District”), be authorized and empowered to levy a renewable supplemental levy as provided in Section 33-802(3), Idaho Code, in the annual amount of Four Hundred Ninety Three Thousand Five hundred and 00/100 Dollars ($493,500.00) per year, for two (2) years beginning July 1, 2024 and expiring on June 30, 2026, for the purpose of paying all lawful expenses of maintaining programming and operating the schools of the District which levy will result in an estimated average annual cost to the taxpayer of the proposed levy in the form of a tax of $ 45.56 per one hundred thousand dollars ($100,000) of taxable assessed value, per year, based on current conditions? The proposed levy replaces an existing levy that will expire on June 30, 2024_ and that currently costs $ 45.70 per $100,000 of taxable assessed value.” The statement shall also disclose that, if the proposed levy is approved, the tax per $100,000 of taxable assessed value is expected to decrease the tax by $ 0.14 per $100,000 of taxable assessed value.

Purpose: Levy dollars will supplement funding for safety, a Student Resource Officer, athletic and other student body activities, curriculum and professional development, maintenance, technology, preschool, and a Community Schools Coordinator/School District Nurse. See table below.

| Budget Category | 2024-25 | 2025-26 |

| Safety- alarm system subscription and maintenance, control panel replacement, fire extinguisher maintenance and or replacement, fire sprinkler repair, surveillance. | $18,000 | $8,000 |

| Student Resource Officer- salary | $40,000 | $40,000 |

| Athletic and other Student Body Activities- including coaching/advisor salary & benefits, advisors, referee and umpire fees, IHSAA fees, equipment maintenance and purchase costs, tournament fees, travel expenses, and event fees. | $170,500 | $170,500 |

| Curriculum and Professional Development- books, staff training, supplies, resources such as subscriptions and printables. | $10,000 | $10,000 |

| Maintenance –pavement patches, roof repair, general grounds such as drainage, sod, sprinklers, propane enclosure, hot water return, and restroom plumbing, boiler repair and or replacement, electrical light ballast repair or replacement, electrical outlet repair or replacement, sewer repairs and maintenance, paint outside wood structures and inside walls, wood railings and ramps, door sanding and painting, door closing mechanism repair or replace. | $100,000 | $100,000 |

| Technology –90 Chromebook replacements, Chromebook screens, keyboards, batteries, USB and power port replacements. Google Education cloudware maintenance, OS and Server licenses, filtering and firewall subscription, port switch repair or replacements, WiFi Access point replacements, battery backup replacements. Staff computer repair or replacement, student lab desktop repair, desktop upgrades, and or desktop replacement, printer/copy machine repair, maintenance, and leases. | $60,000 | $70,000 |

| Preschool –staffing, supplies, heating. | $55,000 | $55,000 |

| Family Health Coordinator/Registered Nurse | $40,000 | $40,000 |

| Total | $493,500 | $493,500 |

In Favor of _____ ; Against_____.

Said election will be conducted pursuant to Title 34, Idaho Code.

Said election will be held at the following polling places:

Idaho City #50

419 Main Street

Idaho City, Idaho 83631

Mores Creek # 70

Wilderness Ranch Fire Station

46 Wilderness Ranch Road

Boise, Idaho 83716

Placerville # 80

Placerville Fire Station

115 Grimes Pass Road

Placerville, Idaho 83666

Absentee Voting

Boise County

Elections Department

420 Main Street

Idaho City, Idaho 83631

Telephone (208) 392-4431 ext. 21

Facsimile (208) 392-4473

http://www.boisecounty.us/Elections.aspx

(The second notice of election, to be published not less than five ( 5) days prior to the election, will be the same as above and shall also include the following statement and a facsimile of the sample ballot.)

How much does the school district spend on maintenance each year?